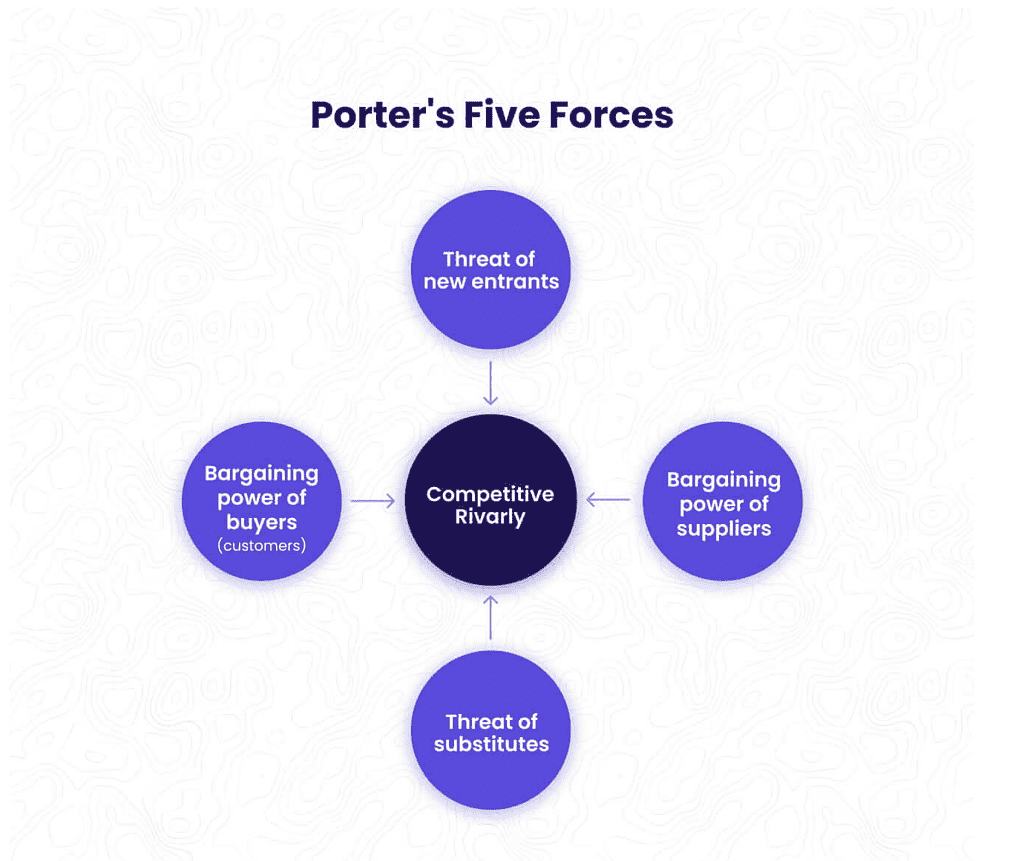

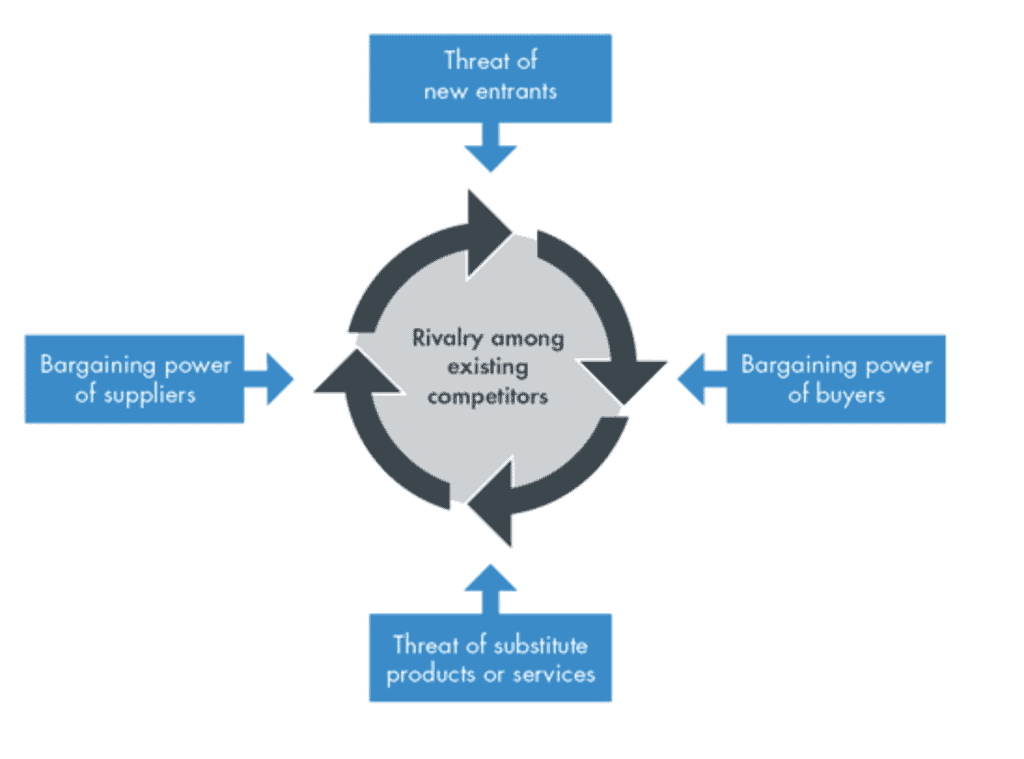

What is Porters Five Forces?

Framework/theory of Porters Five Forces

Michael E. Porter of the Harvard Business School created Porter’s Five Forces of Competitive Position Analysis in 1979 as a straightforward framework for determining the competitive strength and position of a business organization.

This theory is predicated on the idea that a market’s competitive intensity and attractiveness are determined by five forces. Porter’s five forces can be used to determine who has the advantage in a given business situation. This is helpful in determining both the strength of an organization’s current competitive position and the strength of a position it may seek to occupy in the future.

Porter’s five forces are frequently used by strategic analysts to determine whether new goods or services have the potential to be profitable. The theory can also be used to recognize areas of strength, to strengthen weaknesses, and to avoid mistakes by understanding where power lies.

Understanding the Five Forces of Porter

A business analysis framework called Porter’s Five Forces can help to explain why different industries are able to maintain varying levels of profitability. The model was made available in 1979’s Competitive Strategy: Techniques for Analyzing Industries and Competitors by Michael E. Porter.

The Five Forces model is frequently used to evaluate a company’s corporate strategy as well as its industry structure. With some qualifications, Porter identified five immovable forces that affect every market and industry in the world. The attractiveness, profitability, and level of competition in a market or industry are frequently assessed using the Five Forces model.

1. Industry Competitiveness

The number of competitors and their capacity to undercut a firm are the first of the Five Forces. The power of a company decreases as the number of competitors and the number of comparable goods and services they provide increases.

If a competitor can provide a better deal or lower prices, suppliers and customers will look to them. On the other hand, when there is little competition, a company has more negotiating power and can raise prices to boost sales and profits.

2. Potential of new entrants into the industry

The force of new entrants into a market has an impact on a company’s power as well. An established company’s position may be significantly weakened the quicker and cheaper it is for a rival to enter its market and become a viable rival.

It is ideal for existing companies within an industry with high entry barriers because the company would be able to charge higher prices and negotiate better terms.

3. Power of Suppliers

The Porter model’s next factor examines how easily suppliers can raise input costs. It is influenced by the number of suppliers of a good or service, the degree to which these inputs are special, and the cost to a company of switching suppliers. A company would be more dependent on a supplier in an industry with fewer suppliers.

As a result, the supplier is in a stronger position and has the ability to increase input costs and demand additional trade benefits. On the other hand, a business can keep its input costs low and increase its profits when there are numerous suppliers or low switching costs between competing suppliers.

4. Power of Customers

One of the Five Forces is the power or capacity of the customer to influence price reductions. It is influenced by the quantity and value of a company’s buyers or customers, as well as by how expensive it would be for a company to find new markets or buyers for its goods.

Each customer has more power to bargain for lower prices and better deals because the client base is smaller and more powerful. It will be simpler for a business with lots of small, independent clients to raise prices and boost profitability.

Businesses can increase their profits by using the Five Forces model, but they must constantly check for changes in the Five Forces and modify their business plans accordingly.

5. Threat of Replacements

The fifth and final force focuses on alternatives. Threats come from substitute products or services that can be used in place of a company’s goods or offerings. Companies with the ability to raise prices and secure favorable terms will be those that produce goods or provide services for which there are no direct alternatives. Customers will have the option to choose not to purchase a company’s product when close substitutes are readily available, which can weaken a company’s position in the market.

An organization can modify its business strategy to more effectively use its resources and produce higher earnings for its investors by comprehending Porter’s Five Forces and how they apply to an industry.

What Function Do Porter’s Five Forces Serve?

Managers and analysts can better understand the competitive environment a company operates in and how it is positioned within it by using Porter’s Five Forces Model.

The Porter Five Forces Model: Is It Still Useful?

Yes, despite being developed more than 40 years ago, the Five Forces Model is still a helpful tool for figuring out how a company is positioned in the marketplace.

What Are a Few Porter’s Five Forces Drawbacks?

The Five Forces model has some drawbacks, including being backward-looking, which limits the relevance of its findings to the short term and is exacerbated by the effects of globalization.

Another major flaw is the propensity to use the five forces to analyze a specific company rather than the entire industry, which is what the framework was designed for.

The way the framework is set up forces every company to belong to just one industry group, even though some companies operate in more than one. The requirement to evaluate all five forces equally when some industries aren’t as significantly impacted by all five is another problem.

What Sets Porter’s Five Forces Apart from a SWOT Analysis?

Tools for analyzing and making strategic decisions include Porter’s Five Forces and SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis. While businesses, analysts, and investors frequently use a SWOT analysis to take a closer look inside an organization to assess its internal potential, they typically use Porter’s 5 Forces to analyze the competitive environment within an industry.

When examining a corporation’s competitive environment, the most crucial factors should be taken into account are those listed in Porter’s Five Forces framework. High threat levels typically indicate the possibility of declining profits in the future, and vice versa.

For instance, if entry barriers are absent, a young startup in a rapidly expanding industry may find itself shut out very quickly. Similar to how a company selling products with many alternatives will not be able to use pricing power to increase margins and may even lose market share to rivals.

Porter’s model was so widely used because it forces businesses to consider their entire industry when making long-term plans, rather than just their immediate business. Porter’s still plays a significant part in that, but it shouldn’t be the only tool used to develop a business strategy.

Porter’s classic “five forces” model of competitive analysis to Bangladesh’s singular business environment

Because Bangladesh is unique in many ways due to its cultural and linguistic diversity, can general management theories be tailored to suit Bangladeshi business? I decided to use the well-known “five forces” model developed by Michael Porter, professor of strategy and competitiveness at Harvard University, to provide a company with insights into the potential profitability of a market and assist it in developing its strategy accordingly.

The threat of new competition is the first force addressed by the analysis framework. Unless your market’s barriers are formidable, new players can enter and take your share. Of course, if you want to enter a new market, you want these barriers to be low.

If Porter were a Bangladeshi, he would recognize that factors like state protectionism and a lack of infrastructure pose a greater barrier to entry in Bangladesh than they do in more developed countries where market forces are more powerful. This is because governments in emerging economies are often hesitant to welcome new players in many sectors. Even if they do, it is likely that they will later adopt more interventionist policies.

Bangladesh’s textile industry, for example, is poised for growth, but the fact that it was recently deregulated makes it more difficult for competitors to develop long-term strategies, because all such strategies will fail if the government believes that new entrants are threatening its home market.

Public opinion, which has a significant influence on the government in Bangladesh, is one factor that could play a critical role.

Local retailers, for example, are concerned that the arrival of foreign retail behemoths will force them out of business. Foreign companies have made significant investments in Bangladesh, but they must work around stringent regulations that prevent them from doing simple things like putting their brand name on store shelves.

Because dealing with regulators comes before dealing with competitors, the psychological profile of stakeholders can be critical to your competitive strategy. This is not the case in developed economies, where regulators are more willing to let the market take its course.

Of course, they don’t rely entirely on market forces to determine competition, and there can be opposition to takeover bids for household names, as was the case in the UK when Kraft acquired Cadbury, but developing countries are far more conservative and view such M&A deals with skepticism. While innovation is seen as beneficial to the economy in the West, it is still viewed as a threat in Bangladesh.

Supplier bargaining power is Porter’s second force. The model assumes they have significant sway over a corporate customer. Companies in developed countries typically have a larger pool of high-quality suppliers and are less concerned about their ability to fulfill contracts, but this is a major issue in Bangladesh. Most businesses in this area have a backup plan, which means they have already chosen a supplier who will be used if the first choice fails to deliver.

Most developed-world businesses have learned the hard way that any system that focuses solely on cost reduction is flawed, and that they must also consider quality. Buyers in Bangladesh are less likely to demand quality, so retailers are hesitant to seek it.

Bangladeshi firms typically face one of two scenarios: they have no suppliers at all for prospective products, or they have too many untrustworthy suppliers crowding the industry. This is due to the “bandwagon effect”: any company that makes a profit quickly attracts competitors into its market.

These new competitors may lack the infrastructure or quality processes to outperform the original player, but they put pressure on it to deliver quickly and at the lowest possible cost. This is in contrast to western or Japanese business cultures, where few companies would consider suppliers working below a quality benchmark.

Buyer bargaining power is the third force. Bangladesh, as a country with a high level of poverty, is a price-sensitive market with strong buyer bargaining power. Consumers in this country are always looking for the best deal, putting pressure on businesses to keep their prices low. This can result in a pricing race to the bottom, which can be harmful to both suppliers and buyers in the long run.

Furthermore, due to the lack of regulation in Bangladesh, buyers frequently have more power than they would in more developed markets. In the pharmaceutical industry, for example, buyers can demand discounts or other concessions from suppliers. This is due in part to the fact that Bangladesh has a very limited healthcare budget, which means that companies must be price competitive in order to secure contracts.

The threat of substitutes is the fourth force. In Bangladesh, the threat of substitutes can be significant, especially in industries with low entry barriers. In the food and beverage industry, for example, there are numerous local competitors offering similar products. This means that in order to remain competitive, businesses must differentiate themselves.

Finally, the intensity of competitive rivalry is the fifth force. This force is especially strong in Bangladesh, where many industries are overcrowded. In Bangladesh, for example, there are numerous players competing for market share in the mobile phone industry. In order to stand out from the crowd, this can lead to aggressive pricing strategies and a focus on differentiation.

In conclusion, while the five forces model can be applied to any market, Bangladesh’s unique characteristics mean that some of the forces are more important than others. Companies doing business in Bangladesh must be aware of the specific challenges they face, such as a lack of infrastructure, a price-sensitive market, and a crowded competitive landscape. Companies can position themselves for success in this volatile market by understanding these challenges and developing strategies to address them.

Five Forces Analysis in Higher Education

The following is an example of Porter’s Five Forces Analysis applied to higher education:

Under each force, you should evaluate the threat, ranging from low to high.

Five Forces Analysis in the Airline Industry

Here’s an example of analysis for the airline industry that was developed and framed for the International Air Transport Association (IATA) by Michael E. Porter himself:

Hire a Competent law firm for your cross border transactions in Bangladesh:

Tahmidur Rahman Remura TLS Associates is comprised of competent Barristers and Advocates with expertise in multiple legal fields, allowing them to provide the required services to a high degree and allowing clients to acquire all necessary and supplementary legal services under one roof.

The Barristers, Advocates, and attorneys at Tahmidur Remura TLS in Mohakhali New DOHS, Dhaka, Bangladesh have extensive experience assisting clients with all sort of licensing matters. For questions or legal counsel, please contact us at:

GLOBAL OFFICES:

DHAKA: House 410, ROAD 29, Mohakhali DOHS

DUBAI: Rolex Building, L-12 Sheikh Zayed Road

LONDON: 1156, St Giles Avenue, Dagenham

Email Addresses:

info@trfirm.com

info@tahmidur.com

info@tahmidurrahman.com

24/7 Contact Numbers, Even During Holidays:

+8801708000660

+8801847220062

+8801708080817

0 Comments